How To IRS Forms 8283 Document Editor Online?

Easy-to-use PDF software

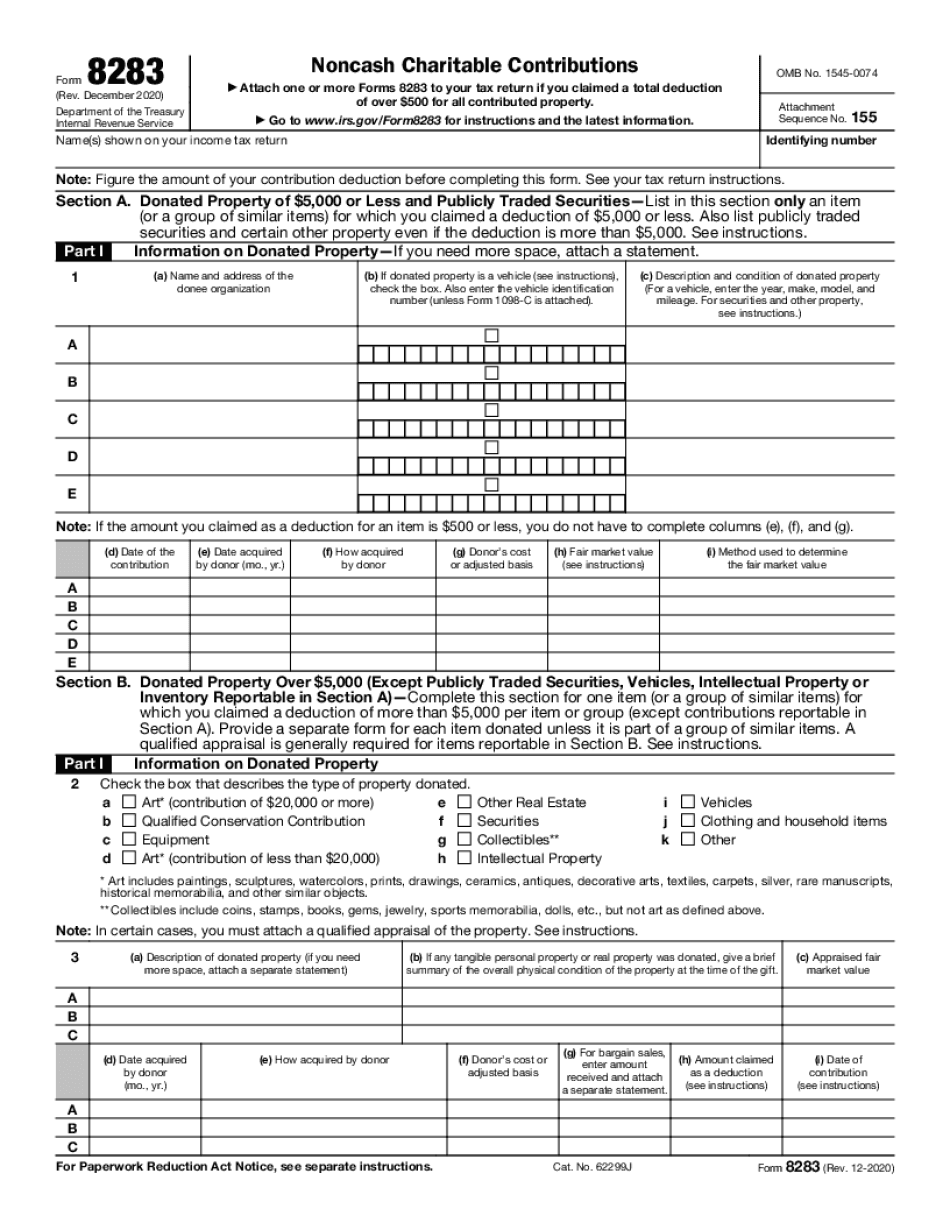

What is IRS Forms 8283?

You must file Form 8283, Section B, if you are contributing a single article of clothing or household item that is not in good used condition or better and for which you are claiming a deduction of over $500.

How to start Document Editor for IRS Forms 8283

Looking for a Document Editor for IRS Forms 8283? You’re about to find it. Forget about printing and scanning for sure and save time with our web-based service. The solution offers you all the tools you need to create, fill out and submit a form in clicks. Plus, you don't need to install anything else; the platform is available for mobile and laptop through any browser. Read the brief guide below to learn how to get started with Document Editor for IRS Forms 8283:

- Visit our website and open the form with an editor.

- Select a tool from the menu to add text, images, checkboxes, stickers.

- From the side menu, drag and drop fillable fields for text, signatures, date, numbers, etc.

- The Reorder Pages option allows you to rotate, rearrange and duplicate pages in the pop-up window.

- Make the document enforceable by signing it with the Sign tool.

- Click the orange Done button to save the edits you've made.

Work with documents simply from any device using our platform. The service is comprehensive yet user-friendly so that you can handle any PDF-related problem easily and level up your document management in general.

Benefits of trying our Document Editor for IRS Forms 8283

There're a lot of solutions on the market that help you work on a document. So choosing an ideal app can be challenging, especially if you don't have time for comparing different alternatives. Check out our service in clicks and enjoy a superior user experience. Our intuitive interface lets you start running the service hassle-free without a time-consuming learning curve. Cope with documents easily and forget about burdensome tasks once and for all. Get to know the best benefits of Document Editor for IRS Forms 8283:

- Secure workflow

- Regular access to data

- Advanced editor

- Web-based solution

- User-friendly interface

Available from any device:

- Smartphone or iPhone

- Tablet or iPad

- Laptop or PC

Need a template of IRS Forms 8283?